Leadership is crucial for accountants, advisers, and all business owners pursuing growth, succession, and business mastery. Effective leadership fosters teamwork, drives innovation, and ensures a seamless transition within the firm. Leadership unlocks hidden potential and is the only way to effectively inspire your employees, adapt to industry changes, and cultivate future leaders. Mastering your leadership skills is the key to achieving individual success and contributing to the organisation’s long-term prosperity and sustainability.

Clarity, Focus & Implementation

Clarity ensures everyone is on the same page and working towards a common purpose, combining energy and drive. When leaders and employees clearly understand where the business is now, where it needs to go, and what stops it from getting there, they can align their efforts and make informed decisions supporting the overall strategy.

Focus enables leaders to innovate, grow, and evolve. Focus creates the ability to work on “first things first and second things not at all”. Many business directors and leaders report frustrations with keeping their organisations focused and performing optimally. We are world leaders in bringing this objective to life. When focused, smaller firms can outperform larger competitors, increasing the likelihood of success and sustainability.

Implementation is where many firms are found wanting. Even the most brilliant strategy can fail to deliver results without effective implementation. Focusing on execution ensures that the business is progressing towards its goals and that adjustments can be made when necessary.

Our Best Practice formula empowers small businesses to navigate the competitive landscape, adapt to changing conditions, and achieve sustained success. Furthermore, companies can build momentum and confidence by seeing tangible ROI, inspiring further growth, and achievement.

Culture Change

Cultural change can have a profound impact on achieving growth, succession, and technology adoption. Here are the benefits in each of these areas:

Achieving Growth

Agility

A culture that embraces change and innovation allows the organisation to adapt quickly to market shifts and seize growth opportunities.

Improved Customer Focus

A customer-centric culture ensures that all decisions and strategies revolve around meeting customer needs, driving customer loyalty and retention.

Entrepreneurial Spirit

A culture that encourages risk-taking and creativity fosters an entrepreneurial mindset, leading to new products and services that can fuel growth.

Collaboration and Teamwork

A culture of collaboration promotes cross-functional cooperation, enabling the organisation to leverage diverse expertise to tackle growth challenges effectively.

Succession Planning

Leadership Development

A culture that values continuous learning and development prepares employees for leadership roles, ensuring a pipeline of capable successors.

Knowledge Sharing

A culture that encourages knowledge sharing and mentorship facilitates the transfer of critical skills and expertise from experienced leaders to emerging ones.

Talent Retention

A positive culture can attract and retain top talent, making it more likely that the organisation will have skilled individuals ready to step into key positions when needed.

Effective Technology Adoption

Embracing Innovation

A culture that embraces change and innovation is more likely to be open to adopting new technologies that can improve efficiency and productivity.

Tech-Savvy Workforce

A culture that values digital skills and technology literacy encourages employees to stay updated with the latest tools and platforms.

Faster Implementation

A culture that supports technology adoption ensures a smoother and quicker implementation process, minimising resistance, and delays.

Continuous Improvement

A culture of continuous improvement encourages the organisation to assess and upgrade its technological infrastructure regularly.

Overall, culture change is pivotal in creating an environment where growth is embraced, succession planning is integrated, and technology adoption is effective.

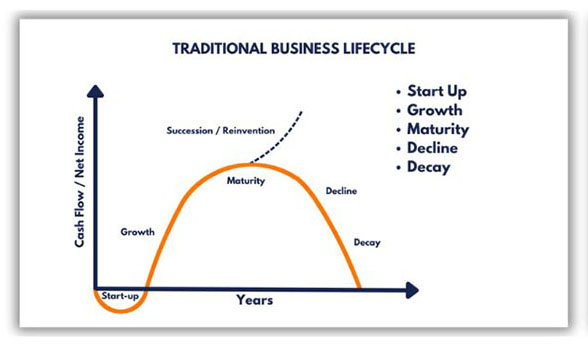

Equity Dilution

Equity dilution can lead to growth and sustainability for several reasons. Equity dilution refers to the decrease in an existing shareholder’s ownership percentage of a company when new shares are issued. The following diagram demonstrates the difference between a poorly structured and a well-structured equity dilution policy:

Here’s how equity dilution can contribute to your firm’s growth, prosperity, and sustainability:

Attracting Talent

Talented individuals often seek opportunities to work for companies with a promising future and the potential for significant financial rewards through equity participation. Therefore, equity opportunities attract top talent more than salary and wages.

Opportunities for Expansion

The funds raised through equity dilution can be used for growth options that may not have been possible beforehand. This can include acquisitions, launching new products and services, or expanding your firm’s geographic reach. Diversifying revenue streams and tapping into new opportunities can also contribute to long-term sustainability.

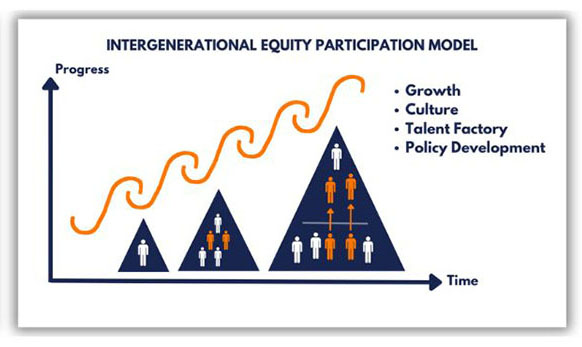

Intergenerational Appeal

A small business with diverse shareholders can benefit from a broader range of perspectives and client reach. Younger equity participants help your firm to innovate and maintain the pace of technology adoption and regenerate your firm’s potency in attracting and retaining younger clients. This can de-risk your firm from client losses as new generations grapple with succession planning.

Scaling Up

Locking in your talent pool creates long-term certainty and business scalability. This creates peace of mind, work-life balance, and compounding growth potential. A well-structured business that develops excellent corporate governance, which includes equity dilution and intergenerational participation policy is more likely to maintain sustainable growth in the mid to long term.

Enhanced Credibility

Creating an intergenerational leadership structure dramatically enhances the firm’s credibility and client appeal. An Advisory firm that leads by example becomes extremely attractive to its client community, as most SME clients want this advisory support from their accountants and advisers so they too can master their businesses.

Liquidity for Founders

Equity dilution allows founders to realise some capital returns from their shares. This liquidity can be crucial for founders wanting to reinvest in the business or diversify their investments. It can also incentivise them to continue growing the company rather than looking for an early exit, as increasing enterprise value becomes highly appealing to aging principals as they dilute progressively.

Overall, equity dilution can be a powerful mechanism for smaller firms to attract talent, take capital off the table, and position themselves for growth and sustainability in today’s competitive market. However, business owners must approach equity dilution strategically, ensuring a clear vision for the company’s future goes beyond self-interest and strike a balance between policy and corporate governance to ensure long-term sustainability.

Growth Strategies

In today’s ever-changing accounting and financial landscape, sustainable growth requires quality, innovation, productisation, and systemisation. Understanding what your ideal customers want and designing well-structured products and services your team can deliver to build brand loyalty is essential.

Understanding how to integrate your team’s ongoing training and development into value-adding will ensure your team “grows with your clients” and is critical to long-term sustainability.

In a client-centric approach, knowing your target market and knowing your target market and their specific needs is crucial for success in a client-centric approach their specific needs is crucial for success. for success. It is important to determine the characteristics and demographics of the clients who can benefit the most from your firm’s services.

Communication is a vital aspect of any professional service. Understanding client needs involves:

Active listening

Train employees to listen to clients actively, asking relevant questions to gather comprehensive information about their financial goals and challenges.

Paraphrasing

Restating and clarifying clients’ statements demonstrates that the firm understands their concerns and is committed to finding solutions.

Building rapport

Develop strong relationships with clients by showing empathy and genuine interest in their financial well-being.

To stand out from the competition and retain clients, firms should offer:

Transparent pricing

Clearly communicate the costs of various services to clients, making them aware of the value they will receive.

Comprehensive service packages

Develop service bundles that cover a wide range of financial planning and accounting needs, ensuring clients can access all necessary services from one source.

Success Stories

Demonstrate the firm’s expertise through case studies, testimonials, and certifications, emphasising the value clients receive by choosing your firm.

Continuous improvement

Regularly evaluate and enhance the firm’s service offerings based on client feedback and industry advancements.

Leadership is all about creating a learning organisation, capable of embracing these growth strategies and more.

Performance Improvement

Experience tells us that many of you underestimate how much you don’t know about enhancing your firm’s performance. This is often based on “Baby Circus Elephant Syndrome.” This is where performance improvement is often stifled by unconscious limitations that evolve within your firm. This typically occurs when directors stop learning and plateau in their knowledge of how to drive performance improvement.

Performance improvement lies at the core of any successful business. By applying best practice continuous improvement methodologies, you and your team can learn how to identify bottlenecks, implement targeted enhancements, and dramatically improve your ongoing performance.

Embracing data-driven insights and fostering a fresh leadership culture of continuous improvement can empower your firm to improve performance. This can dramatically improve your firm’s ability to meet and exceed customer expectations through enhanced performance.

Learn how much opportunity there is to improve your firm’s performance by arranging a confidential obligation-free discussion today.

Productivity & Profits

Driving capacity and organisation-wide productivity is a crucial driver of profitability. Companies can achieve higher output with fewer resources by streamlining workflows, leveraging automation and technology, and investing in employee training.

Best Practice Daily leadership practices can dramatically affect productivity and profitability. We boast arguably the world’s most comprehensive time management and productivity improvement systems for Accountants and Professional Services firms.

Our leadership intervention programs yield astonishing financial outcomes, leaving no room for doubt about the effectiveness of the application methods, resulting in remarkable productivity increases ranging from 50% to 280%.

*Case studies available upon request.

Succession Planning

As businesses grow, succession planning becomes paramount for sustained success. Preparing the next generation of leaders, identifying talent, and establishing clear pathways for advancement ensures a feasible transition of responsibilities. Thoughtful succession planning fosters continuity, minimises disruptions, and instils stakeholder confidence, assuring the organisation’s ability to thrive beyond the tenure of its current leaders.

The challenge for most firms is the fear of redundancy among founding directors and ageing principals. Redefining statesman-like roles and responsibilities can improve long-term sustainability and continuity for all stakeholders. The key is tapping into genuine expertise to create confidence, valuable company policy, and intellectual property that will stand the test of time.

Committing your firm to become a learning organisation is essential. By creating a talent factory within your firm, you can identify emerging client managers and future leaders, improving the talent matrix and sustainability of growth and the quality of your culture. Additionally, defining roles that recognise your ageing partners so they are dignified with respect and appreciation will create smoother transitions and intergenerational harmony.

For accountants and advisers, mastering your succession plans creates a powerful well of internal knowledge and intellectual property that becomes extremely appealing and valuable to your client communities. Getting this right internally creates much more prosperity for your firm’s community than you may first imagine!

Team Development

An engaged and cohesive team is the backbone of any thriving organisation. Investing in team development through training, mentorship, and fostering a positive work environment will help cultivate a motivated and skilled workforce. Higher employee morale leads to increased productivity, innovation, and lower staff turnover rates.

Having team targets that foster unity and a success-oriented culture makes this even more achievable. Learning to apply best practice team development and performance-enhancing strategies will have a substantial impact on your team’s ability to adapt, learn and grow in confidence and capability.

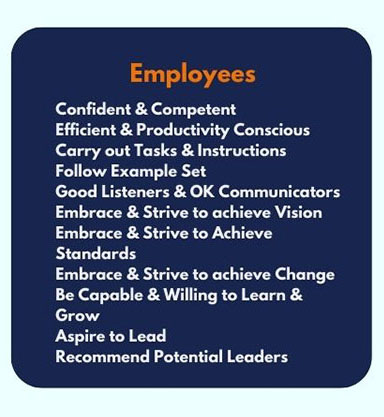

This is only achieved by setting high standards of emotional intelligence and team-oriented behaviour. The following diagram outlines the three layers of team structure and the key attributes of high-performance organisations.